Wednesday, 23 December 2009

SlackBelly will be unwell...

Tuesday, 22 December 2009

Cold Hertz

It is frantically ringing customers who had booked in London to tell them that the group has no more cars left in the capital, as apparently the fleet is stuck in the north.

That leaves a raft of customers - including many Gold Club card members - stranded in the city over the festive period. Merry Christmas!

Monday, 21 December 2009

Bottom of the Hill?

I ask as the Nicholls/Walsh combination cleans up in the big races, while racing is being cancelled due to the weather - none of which will go down well with the turf accountants.

Football results have picked up for bookies of late, but they don't usually need much of an excuse to start moaning. Even money.

Friday, 18 December 2009

Double chin and tonic

Lady Isabella Hervey (sister of that awful brat, Victoria) has been engaged as Nicko's new personal trainer, and the jolly spinmeister brags to friends that she is "rather thin".

She doesn't say the same about him.

Wednesday, 16 December 2009

FT brothers scoop their own scoop

Like BA staff, there is a day of action today and a picket (at the FT!). The National Union of Journalists are outside the building, in the snow, and meeting inside to discuss "Unsafe and Unprofessional workloads" says my spy.

The NUJ are also handing out flyers, the highlight of which is this: "Lloyd Blankfein, the Goldman Sachs boss and the FT's 'Person of the Year' is not the only doing God's work - so are FT journalists inproducing premium products for a discerning audience."

A slight problem is that the NUJ staffers have broken an embargo, because the great vampire squid himself has not actually been named Person of the Year by the FT, yet.

Whoops.

Monday, 14 December 2009

Interactive Investor looking for eye-to-eye

Friday, 11 December 2009

Chat blow for Rothschild

Qadbak - which supposedly funded Notts through Munto and once claimed to be buying the BMW Sauber Formula One team - has had to put up with nosey journalists questioning its financing for months. But at least it had the unquestioning support of Rothschild banker, Meyrick Cox, who acted as an adviser to BMW and was so confident in the group that he even chatted with journalists on the subject.

"So Meyrick," my email to the shrewd banker begins. "The Qadbak deal to buy the BMW Sauber team has collapsed. And now the Notts County takeover is unravelling. Many people saw it all coming. But not you! So, I wonder, do you still stick by your comments that Qadbak is a 'wholly reputable organisation'."

So far, no answer from Meyrick. Busy, I expect.

Thursday, 10 December 2009

Notts the way to do it

This time it is former England football boss, Sven Goran Eriksson, who seems to be positioning himself to takeover Notts County, the League Two club where he is director of football.

His partner in this "deal"? The club chairman Peter Trembling, a man who seems to enjoying hanging around with convicted fraudster Russell King and a businessman of such renown that he lives in a three bed semi in Sandiacre. Happy days!

Tuesday, 8 December 2009

A week is a long time in business...

Not quite. Hong Kong has now delayed the flotation.

Friday, 4 December 2009

Bernanke writes another type of sequel

He's been grafting pretty hard over the past two years to make sure he doesn't have to pen the sequel, so we should listen to his criticisms today of Gordon Brown whose decision to strip the Bank of England of its supervisory role over banks led to a “destructive run” and a “major problem for the British economy”, according to the Fed chairman.

Well, we should listen again, that is. Bernanke has said all this before.

Back at a 2006 Treasury Select Committee hearing, chairman John McFall pointed out to Bank of England Governor, Mervyn King: "On a recent visit to the United States we had the opportunity to meet Ben Bernanke and he told us that he prefers to maintain the Federal Reserve's responsibility for banking regulation, due to possible co-ordination problems that might exist between the central bank and the separate regulator in the aftermath of a financial crisis."

King replied that he thought it "only a hypothetical risk".

D'oh!

Wednesday, 2 December 2009

The curse of the award strikes again...

“Financial management of Dubai World is a team effort," she gushed back then. "I regard this award as welcome recognition of the work my finance team and the management of Dubai World have undertaken.”

Too modest!

Tuesday, 1 December 2009

Lewis rides again

That's the listed technology company that also owns a 50% stake in Turf TV, a joint-venture broadcast service with a consortium of 31 racecourses, that beams live racing footage from the top UK courses into bookmakers' shops.

The bookies have always hated Turf TV - which competes with the Ladbrokes- and William Hill-owned rival, SIS - and the new service's creation triggered a number of lengthy legal battles (eventually won by the Turf TV stable).

Still, there are a couple of intriguing points about Lewis's interest not mentioned in today's Telegraph report.

First, Joe Lewis is still thought to be a sizeable Ladbrokes shareholder; and second, the JV deal covering Turf TV contains a change of control clause that allows the racecourses to buy 100% of the broadcasting service if Alphameric gets takenover.

Monday, 30 November 2009

Team sheets omitted from Davies commentary

“It's just not true,” Davies insists to the Evening Standard's City Spy column. “Speculation about a flotation comes up regularly. But we are not about to appoint an adviser.”

The freesheet seems sceptical about that response - and so it should be. What Davies fails to mention is that Goldman Sachs has already been asked by the betting group to handle the £1.5bn listing, while Credit Suisse has also been handed a spot in the starting XI.

Thursday, 26 November 2009

Bolton wanders east

The former Fidelity stock picker is setting up a China-focused fund and will relocate from London to Hong Kong.

Bolton stepped down as manager of Fidelity's Special Situations Fund at the end of 2007 – having run it brilliantly since 1979 – and it was subsequently split in two.

Sanjeev Shah took on the UK Special Situations Fund (which has performed very well), while Jorma Korhonen looks after international holdings in Global Special Situations Fund – which is down since inception (although up nicely this year). So, might the return of Bolton, and the launch of another international fund, put a bit of extra pressure on his former prodigy, Korhonen?

If it does, he has Mrs Bolton to thank. The veteran fund manager mentioned to his missus that he missed running money and fancied creating an Asia fund. She replied: "Why don't you, then?"

Wednesday, 25 November 2009

Dispatching Deripaska

Channel 4's Dispatches is set to broadcast an investigation into a cast of our Russian friends next week - entitled Lords, Billionaires and the Russian Connection. It is not expected to be especially complimentary to either Deripaska, or wannabe Arsenal owner, Alisher Usmanov.

Tuesday, 24 November 2009

A turn up for the books

That's a nice touch. Presumably the decision to part company must have been made in the past few days, otherwise I'm sure the company would have let investors know about the switch when making representations during the fundraising.

Update 24/11/09, 15:10: Simon Lane attended the bond presentations yet failed to mention his job move. Says one investor: "They should really have delayed the process until they had a new finance director. He didn't answer many questions and didn't give out his [business] card." Shoddy.

Friday, 20 November 2009

Dumbing down

Pinstriped boozer: Hedge fund management is hardly rocket science, is it?

Hedge fund manager: No - and I should know. I used to be a rocket scientist.

(Dumbing down is an occasional series dedicated to people forced to take jobs below their capabilities.)

Thursday, 19 November 2009

Every title helps

The retailer has been "honoured" by the University of Hertfordshire (Hatfield Poly as was) with a gong he can now add to the other honorary award he has from Cranfield University (formerly Cranfield Institute of Technology) - plus the 2:1 in management science he obtained from UMIST in 1977 when he actually had to pass a couple of exams.

This latest degree means Sir Terry joins a growing club of business knights who are rather partial to collecting these trinkets. Among their number is the great Sir Derek Wanless - who loves publicising awards from former Polytechnics yet doesn't like talking much about his time as head of Northern Rock's risk committee.

Why do these people do it?

Wednesday, 18 November 2009

Fancy that...

"Marks & Spencer has confirmed it is appointing Morrisons boss Marc Bolland as its new chief executive" - November 17, 2009.

Tuesday, 17 November 2009

Kafka on trial

Vice chairman "Fat Mike" Sherwood - who likes to wear a personalised tracksuit while playing ping pong - used The Times's opinion pages last month to preach to ungrateful readers how Goldman's clients selflessly grow "the savings of millions of people".

Then chief exec Lloyd Blankfein joined the crusade, telling the Sunday Times how he and his disciples are merely performing "God's work".

And, today, the Holy Trinity was completed with chief economist, Jim O'Neill, popping in to give the economic sermon in the Evening Standard.

For some reason, Jim got slightly distracted and waffled on a touch about a trip to China with the missus, but was soon back on message to namecheck his ultimate master.

He argued the credit crisis was "an act of God" for China, before signing off with a quick "thank God for the English language".

After all that, any sane soul would now recognise it's time for Kafka to revert to type and impose a vow of silence. But, like much of his namesake Franz's work, City wags fear his shameless publicity project remains unfinished.

Monday, 16 November 2009

Question Thiam

"You can ask the new man from the Pru anything you like" The Times tells its readers, which is a priceless opportunity that I've been waiting weeks to present itself.

My starter for TT: "Are you finding that your sexual allure has increased since you became chief executive?"

Wednesday, 11 November 2009

Surveillance...

Tuesday, 10 November 2009

A parable of our time

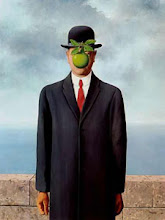

It would be churlish to allow the news that Goldman Sachs is busying itself doing "God's work" without marking the announcement with a new SlackBelly series celebrating the bank's legions of disciples as they go about their good deeds.

It would be churlish to allow the news that Goldman Sachs is busying itself doing "God's work" without marking the announcement with a new SlackBelly series celebrating the bank's legions of disciples as they go about their good deeds.To begin, here's a picture of Goldman Sachs International co-chief executive, "Fat Mike" Sherwood, putting in another shift for the Almighty at the ping pong table while wearing a tracksuit personalised with his own initials.

Fortuitously, this snap landed in my in-box just in time to be included in this feature - proving that there is a God who we can all work to please. He really does work in mysterious ways.

News of a GS banker? Please email the collection plate at postmaster@slackbelly.com.

Monday, 9 November 2009

Blankcheque threads his way through the eye of a needle

Blankfein is, himself, Jewish, but is not adverse to schmoozing those with lines into the other major religious brands.

On Pope Benedict's trip to the US last year, His Excellency dropped in for the first ever papal visit to a US synagogue and met Jewish "leaders" including private-equity billionaire Stephen Schwarzman as well as the Goldman boss.

So, is Blankfein hedging his bets?

Bookie wins shocker

Friday, 6 November 2009

Blair watch project...

The sender? One Euan Blair - son of our glorious former Prime Minister and therefore the progeny of one of London's more opportunistic money-making couples. Who'd have thought it?

Update 09/11/09: Oh dear ... http://www.dailymail.co.uk/news/article-1226063/Euan-Blair-England-rugby-tickets-probe.html.

Media news...

The newspaper has just fired all of its local Washington reporters as part of a cost cutting drive, but perhaps that's just a, er, temporary setback.

The six staffers - all Americans recruited on short-term contracts to crack the US online market for the media group - got their marching orders yesterday, I understand.

The paper, and its sister The Observer, are now just going to have to make do with their old newspaper hacks, who never understood what those web people were doing in the first place...

Dual on the Hill

"I hear that the William Hill boys are out schmoozing the bond markets this week in an attempt to raise some cash for the embattled bookie. Apparently the presentation has been poorly received." - SlackBelly, Wednesday November 4, 2009.

"William Hill was under pressure amid chatter it is about to sell high yield bonds to help refinance its existing £1bn debt pile." - Daily Telegraph, Friday November 6, 2009.

"William Hill traded 2½p lower at 173¾p as the bookie’s presentations to the bond markets failed to capture the imagination. It is looking to raise as much as £250 million, partly to pay down debt." - The Times, Friday November 6, 2009.

Thursday, 5 November 2009

Spinning into trouble with a Greek bearing gifts

CorpComms magazine reports that the CIPR was offered a financial incentive (I'm told £500,000) to leave its former pad before its lease expired, because the landlord planned to turn the Georgian premises into a private home.

What the mag doesn't mention is that the landlord in question is my old friend, Greek property tycoon Achilleas Kallakis, who is currently at the centre of a Serious Fraud Office probe and (under the name Stefan Michalis Kollakis) was convicted of conspiracy to commit forgery 14 years ago.

His offer of payment to the CIPR was apparently only a gentleman's agreement with the trade body's director general, Colin Farrington - and the new owners of the property aren't that keen to honour the "deal" without supporting evidence. Worse, they are also looking to sting the CIPR for breaking its lease early.

None of which now seems to be Farrington's problem, though. He's currently on an "extended leave of absence".

Wednesday, 4 November 2009

Over the Hills?

Update: the offer is for £200 - 250 million senior notes to pay down bank debt and "general corporate purposes". Presumably they've already spent the £350m rights issue cash from April, then.

Tuesday, 3 November 2009

Relocation, relocation, relocation...

I hear that the FTSE 250 company has just signed a deal on new office space in the heart of the Square Mile - just behind Cannon Street station.

The relocation comes after years slumming it at its Blackfriars Road office - an unimpressive building that was (even worse) located south of the river.

Monday, 2 November 2009

Who's the Fuld?

In the mid-1980s, when City firm L Messel was being acquired by the fast expanding investment bank, the young(er) Fuld was parachuted into London and put in charge of the European expansion.

Execs at Messel advised their new ambitious boss that if he was serious about achieving his aggressive plans, then they really needed to open a Frankfurt office.

"No way," he fired back earnestly. "We're never going behind the Iron Curtain!"

Friday, 30 October 2009

Meltdown does the opposite

In August I reported that publisher Macmillan had axed plans for a sequel, despite originally signing the author - hubbie of Madoff victim Nicola Horlick - on a three book deal.

Bad news for the embattled Horlicks, for sure, but it seems that the concept (if not Martin's literary career) has legs. Another City thriller called Meltdown is now due out next month.

"For amiable City trader Jimmy Corby money was the new Rock n' Roll. His whole life was a party, adrenalin charged and cocaine fuelled," the PR puff relays. "If he hadn't met Monica he would probably have ended up either dead or in rehab. But Jimmy was as lucky in love as he was at betting on dodgy derivatives, so instead of burning out, his star just burned brighter than ever."

My guess is that Meltdown II might sell slightly better than the first draft, as it's been penned by the self-proclaimed comedy genius, Ben Elton. Still sounds like a load of tosh, though.

Thursday, 29 October 2009

Executive affairs going on as Standard

The column kicked off its series last week with a story that subsequently turned out to be a reference to insurance boss Andrew Moss and the incestuous goings on at Aviva (who'd have thought it, at a company with strong links to Norwich?)

The paper then followed that up with another tale of some high flying exec banging a former employee - and today has three stories (count 'em!) in the "wicked whisper" format on more corporate canoodling.

This is looking like a trend, and I'm going to experiment with this format myself. So, here goes: which top FTSE-100 chief exec isn't shagging his PA?

Wednesday, 28 October 2009

ICAP walks the protection plank

The renaissance of the pirate has enabled interdealer broker, ICAP, to build up a steady trade in the protection business, by supplying freight ships with commandos (some might call them mercenaries).

Treble (rums) all round!

Tuesday, 27 October 2009

Stuart changes Lanes in move away from IG

Stuart Lane, the respected Extrabet boss, has left the building, which observers are viewing as a possible precursor to the FTSE 250 company offloading its sports division.

Such a deal has long been rumoured, as IG generates the vast majority of its revenue and profit from clients trading financial markets via its IG Index platform, while sports clients are rarely converted into more profitable financial clients - despite the industry's best efforts.

Developing...

Our survey said...

Might it be time for Aviva to reinstate its high profile Cost of Divorce survey?

Monday, 26 October 2009

By George! Soros plays both sides

It's a fair enough point - although he might not be quite the man to make it.

"When I sold sterling short in 1992, the Bank of England was on the other side of my transactions, and I was in effect taking money out of the pockets of British taxpayers," he once gloated. "But if I had tried to take social consequences into account, it would have thrown off my risk-reward calculation, and my profits would have been reduced."

So that's all right then!

Friday, 23 October 2009

Little Miss Moffat frightened away

A similar re-branding might now be the best option for the group's disgraced chief exec Andrew Moss, assuming he wants to escape the embarrassment of his affair with an underling, Deirdre Galvin.

Ms Galvin, of course, has already changed her own name, having previously gone under the moniker of Deirdre Moffat. Presumably, she's now become what she always dreamed of.

Not seeing the Sherwood for the fees

“What is common to the investment banks, commercial banks, mortgage banks and insurance companies that failed in the past year is poor management practice,” he muses.

True, but the implication of Woody's line is that those banks that did not fail were somehow spared by good management. Nothing to do with government bail outs, then.

Wednesday, 21 October 2009

Gilchrist smokes out FTSE execs with a Kamal

Tuesday, 20 October 2009

Fancy that...

"Nothing would be more futile than unilaterally to impose a windfall profits tax on bankers" - Daily Telegraph, B5, October 20, 2009.

Monday, 19 October 2009

Betfair backs vampire squid in flotation stakes

I'm told that the great vampire squid, Goldman Sachs, has been appointed to handle the £1.5bn listing...

Thursday, 15 October 2009

Good news and bad

US president, Barack Obama, and Russian PM, Vladimir Putin, join Klaus in an audience with God.

The Almighty tells them that the world will end in 48 hours - so the leaders return home to report back to their people.

Putin informs Russians that he has good news and bad. The bad news is that there is a God, but the good news is that He is having a dialogue with Russia.

Obama also reports good news and bad: the good is that there is a God. The bad - that the world will end in two days.

Klaus, on the other hand, only sees two pieces of good news when he addresses Czech voters. Firstly, that there is a God. And secondly, that there will be no EU Treaty.

Tuesday, 13 October 2009

O'Leary's panoramic view pays dividends

The cheapo airline has published the interminable correspondence between the warring pair but, as it all makes inconclusive reading, it only serves to fuel the theory that chief exec Michael O'Leary is enjoying keeping this row simmering.

It's a tactic that's paid off before for the Gigginstown Gab - memorably in 2002 when (rather than settling) Ryanair allowed its millionth passenger, Jane O’Keeffe, to take the airline to court for reneging on its offer to gift her free flights for life. That episode ended with the judge finding O'Leary had been “hostile and aggressive” to O’Keeffe, as she trousered €67,500 in compensation.

Bad news for O'Leary? Not a bit of it. “For three days we got the worst publicity any company has ever had in its life,” O'Leary recalled. “Our bookings soared by 30% day by day by day. The more we were in court the bigger the bookings were.”

Monday, 12 October 2009

Expenses spared

Friday, 9 October 2009

A reader writes

In response there is now a SlackBelly Twitter page too! - which will be used solely for the purpose of gently heckling Kamal.

Thursday, 8 October 2009

Surveillance...

Wednesday, 7 October 2009

Flak watch...

Next month he'll join PR group, Maitland, whose client list includes sportswear retailer JJB, which should be an interesting one.

As a hack, Treffers once described the group as the "outfitter of choice for couch-potatoes and others who like wearing cheap sportsgear for an athletic afternoon in the shopping mall" - before implying a rival specialised in selling its stock to drug dealers.

Will he get the JJB account, I wonder?

Update 12/10/09: Tregarne's new job has now been confirmed.

Tuesday, 6 October 2009

Missing pink 'un at the Pink'un

Yesterday evening, every member of the esteemed organ received a missive entitled "supper" from one sub-editor. It read: "Thanks to whoever took my smoked salmon sandwich from the fridge at the back of the first floor. It was the only food I was likely to have today and, at 22.36, my chances of eating now are as slim as my waist will be tomorrow morning."

Monday, 5 October 2009

Bookmakers expecting another game of two halves

The old "struggling bookmaker" line is (of course) one of the oldest tricks in the turf accountant text book - as punters are encouraged to bet more having fallen for the idea that somebody else is the mug for a change. Not for long.

This PR puff story tends to surface each year, and only the details vary. One of the more imaginative efforts came in 2005, when William Hill blamed the Racing Post's chief tipster Tom Segal for its woeful first half.

Did punters' luck hold out? Of course not. When Hills eventually reported its full year numbers, both turnover and profit had experienced healthy hikes. What price on the same happening again?

Friday, 2 October 2009

Oil and Vinegar mix it in PR world

MrO: I’ve always loved it here, since my first visit in 1985 with a very pretty woman who flirted most outrageously with me.

MrV: Did you get anywhere with her?

MrO: No, she was a PR woman and I was a journalist so she was being paid to flirt. I phoned her a couple of weeks later to ask for a date and she didn’t remember who I was.

MrV: That’s PR people for you. Ghastly collection.

Messrs Oil and Vinegar should know. In their real lives the authors are those esteemed City PR people, Piers Pottinger and Damien McCrystal.

Tuesday, 29 September 2009

Ford to reverse away from Dixon again?

You'll recall the move is causing a bit of a kerfuffle because the key players have a history: BV co-founder, Jonathan Ford, left the company in 2007 after a spectacular falling out with his business partner Hugo Dixon. He then re-emerged at Thomson Reuters to launch a rival commentary service - only to see his new baby effectively strangled at birth by this deal. So what's the next instalment?

"My best guess is that the old hands in London will be redeployed, the Ford will be driven off into the sunset, and that the others will remain," says one Reuters insider, before adding: "It's not so neat in New York, though..."

Developing...

Friday, 25 September 2009

Notts the way to do it

Exposé after exposé has appeared in the papers this week about these mysterious moneymen and now one County insider reflects: "I thought there was something up. At last week's game, both Russell and Nathan said they didn't want to sit in the front row of the directors' box". D'oh!

Thursday, 24 September 2009

Bloom with a view

This is not the first time that Bloom has managed to attract controversy. Five years ago he mused : "No self-respecting small businessman with a brain in the right place would ever employ a lady of child-bearing age" - a controversial view expressed with impeccable timing.

The former Mercury Asset Management fund manager made the comments on his first day in the Strasbourg parliament - where he'd just been given a seat on the, er, European Parliament's women's rights committee.

Wednesday, 23 September 2009

Fancy that...

"I see this year’s US Open final as less of a passing of an era ... and more of a cautionary tale for all of us on the court or in business." - Thomson Reuters boss, Tom Glocer, September 18, 2009.

"The parallels between sport and business are overused to the point of being hackneyed." - Thomson Reuters boss, Tom Glocer, September 18, 2009.

Monday, 21 September 2009

Insider goes outside

Yesterday's six story page contained not one - but two - yarns lifted directly from this humble website - tales that were copied out in such haste that the speedy typist had no time to add the usual credit.

No wonder they call it the Express.

Friday, 18 September 2009

Surveillance...

Nicola, sporting a pair of trainers, drove away with her bag of groceries in a silver VW Beetle.

Didn't she used to employ staff for this type of stuff?

Wednesday, 16 September 2009

Oh FT - no comment

TEB has started a new feature called Lex Watch which seems to be designed solely to slate the Pink 'Un's back page comment section.

He writes: "The Financial Times Lex column was once thought provoking, informative, and occasionally witty. Now it is lazy warmed-over, regurgitant, boring, with a narcissistic emphasis on style wrapped around flabby content – or am I just having a bad day?"

It seems not - as he's followed it up with a couple more scathing Lex postings, making my obsession with the Telegraph's Jeremy Warner seem positively healthy.

Monday, 14 September 2009

No hedgie u-turn on Porsche

You'll recall how, last year, funds short-selling Volkswagen took a savage goosing from the sports car group (which is also VW's biggest shareholder) after it took advantage of a controversial German legal loophole allowing it to secretly take its VW stake to almost 75%.

In fact, those wounds remain fresh and many hedgies have been told by bosses to stay away from Porsche shares - news that might just amuse Porsche execs even more. Schadenfreude, they might call it.

Friday, 11 September 2009

Davis's new award fails to hit the Marx

Davis has accepted one of those dreadful honorary degrees from Coventry University (Lanchester Poly, as was) - the same mob who thought it a bright idea to similarly honour Sir Derek Wanless, the former head of the Rock's risk committee, just months after his customers queued down Britain's highstreets to get their money out.

Davis also joins the likes of television's Richard Keys and disc jockey Simon Mayo, who both felt insecure enough to collect one of these silly baubles from the former polytechnic and thereby ignored the sage teachings of Marx. Solid work.

Tuesday, 8 September 2009

Todd presses the wrong Cadbury button

Yet, in March, Stitzer sold off £2m worth of shares at £5 a throw. Believe in yourself, boy!

Monday, 7 September 2009

Another nice mess, Stanley

Friday, 4 September 2009

Jones fails to keep up with the meerkat

This is down to the success of rival comparethemarket.com's brilliant commercials, featuring their speaking meerkat character, Aleksandr Orlov, pictured below, the boss of comparethemeerkat.com.

This is a nice coup for Aleksandr (and an equally satisfying development for viewers who can't stand the self-regarding Jones), but might the entrepreneur's Dragons' Den colleague, Evan Davis, now be a touch concerned?

It's been pointed out before that Evan and Aleksandr bear a striking resemblance to each other. Could Jones now take out his meerkat frustrations on the wrong man?

Pavis bracing for a Brady bunch of fives

She will be in the boardroom at Meadow Lane to watch Sven Goran Eriksson's Notts County take on Burton Albion, the Football League newcomers who are managed by Mr Brady, aka Paul Peschisolido.

This invitation should rank as an even greater coup for Ms Brady than scooping her new reality telly role, after she famously fell out with County's former chairman, Derek Pavis, when he suggested that women should not be allowed inside football club boardrooms.

Pavis is likely to be in attendance tomorrow too. Developing...

Update: my story seems to have prompted bookmaker Paddy Power to start a betting market.

Thursday, 3 September 2009

The Treffers Guardian angle

Sadly for the Graun, Treffers - the former speech writer to former BP boss Lord Browne -moved beyond petroleum months ago. Another one for the corrections and clarifications column, then.

Wednesday, 2 September 2009

How football transactions work...

"ASTON VILLA were given dispensation to complete a £5million deal for Richard Dunne last night as negotiations over his departure from Manchester City rumbled on past the 5pm deadline." Daily Mail, September 2, 2009.

Friday, 28 August 2009

Tappin keeps tappin' away

You'll recall that I pressured him into altering the page once before, after he used it to claim he was a "CEO confidant for some of the CEOs of major global corporations such as Tesco, Deloitte and RSA". Sadly for Steve, Tesco, Deloitte and RSA didn't agree.

Despite the minor correction, however, it seems Tappin's tinkering has not satisfied the Wikipedia independence police, who have slapped a health warning on the Steve Tappin page.

"This article is written like an advertisement," it informs the website's contributors. "Please help rewrite this article from a neutral point of view. For blatant advertising that would require a fundamental rewrite to become encyclopedic, use {{db-spam}} to mark for speedy deletion. (August 2009)".

Ouch!

Thursday, 27 August 2009

My Teddy where?

Is that a book contract in your pocket?

As you'll all know by now, Weinstein has written a book which lifts the sheets on how she got off with Madoff, revealing such gems as her achieving a climax despite Bernie's miniscule genitalia.

The thoughts of hubbie Ronald on his wife's new found taste for honesty appear to have been unrecorded so far, although if he's a crossword buff he may have long suspected his errant missus.

Sheryl Weinstein, I discover, is an anagram of Relishes Wen Tiny.

Wednesday, 26 August 2009

Tidal turns into an exclusive exclusive

Sadly, the tweeting and blogging community don't seem that impressed. In particular, islayblog.com points out that Scottish Power put all of this on a press release which was sent out in September. So, it was an exclusive in the sense that no one else bothered to copy it out. It may well remain exclusive for many years to come.

Tuesday, 25 August 2009

Media news...

It is also strongly rumoured that his deputy will be David Dinsmore, editor of the Scottish Sun, who is in London tomorrow. This will of course create an interesting vacancy at the top of the Scottish Sun, which is now Scotland's biggest-selling daily.

Update 26/08/09: Dominic Mohan has now been confirmed as editor.

Friday, 21 August 2009

It pays not to watch

Musing on his blog, the professional meanie blames "property porn shows" for punters overextending themselves and defaulting on their mortgages - before heartily congratulating himself on having the genius to foresee this entirely foreseeable pickle.

Still, Lewis should know how even the most brilliant financial telly presenters can sometimes stitch up the humble viewer. Thanks to his stupid campaign to help feckless people claim back money they have been rightly charged by banks, we are probably going to lose free banking. Solid work.

Footnote to Lewis: it is most unseemly to slag off rival (low grade) television genres when your own pisspoor show has been dumped.

Tuesday, 18 August 2009

Meltdown for Baker

The self-regarding husband of embattled City Superwoman, Nicola Horlick, has long promised a follow-up to his dreary debut novel, writing in Square Mile magazine two years ago: "I wanted to make the change from journalist to writer. And that’s something I’m doing. You could argue, given a three-book fiction deal with Macmillan ... it’s something I’ve already done ... Meltdown is being promoted as a major title in Macmillan’s list on its publication in January 2008."

Over to Macmillan. "We have no plans to publish Meltdown II," blocks a spokesman.

Or, as the great writer himself penned, back in 2007: "I’m in limbo, 34,000 words into novel number two, and still unsure how to manage the entrepreneurial change from journalist to author."

The man's a prophet!

Thursday, 13 August 2009

Parky works over-time on unemployment

The former Tory Trade Secretary's statistic got lots of coverage at the time, and at a cabinet meeting shortly after his proclamation, Parkinson tells how he was taken aside by Michael Heseltine (as was).

"Is that stuff about Labour and unemployment really true?" he asked.

"It was at that point that I knew the challenge I had to persuade voters," Parkinson recalls. "I couldn't even convince my own cabinet I was right."

Wednesday, 12 August 2009

Labour statistics keep on repeating...

Plus ca change. Former Tory Trade Secretary, Lord Parkinson, is fond of telling a story of how he once pointed out that every Labour government has left office with unemployment higher than when it arrived. An incredulous reporter asked the then opposition leader, Neil Kinnock, if Parkinson's claim was indeed true.

Kinnock's reply? "Well, statistically speaking."

Friday, 7 August 2009

Black and white and red all-over

Retail tycoon Mike Ashley is desperately hawking his comedy football club around the City for a £20m cash down payment, and now I learn of a struggling property deal.

Swainston Hall, an 8,000 sq ft neo-Georgian mansion based on a Robert Adam design, is located on the Wynyard Hall estate developed by former Toon chairman Sir John Hall.

It is currently being offered at a 15% discount for £2.95m and estate agent Jackson-Stops says: "The house is a real one-off, so quite hard to value."

Evidently.

Thursday, 6 August 2009

IG bargy for unpaid debts

The company's eager credit controller, Catherine Crowther, writes to one SlackBelly reader: "I am contacting you regarding the debit balance due on your IG Index account. The amount due is currently £6.60. We require this balance to be cleared in full as soon as possible."

Steady on, luv!

Wednesday, 5 August 2009

More Babs...

Her CV makes fascinating reading - revealing under her "interests" that (apart from writing her debut novel) she has recorded her first album. First!

Tuesday, 4 August 2009

Babs fails to reveal all

Monday, 3 August 2009

Jeeves still searching for a better answer

The butler-branded search engine, Ask Jeeves, still seems to be stoically plugging away in this space, so I ask Jeeves: "Is Ask Jeeves finished?"

His first response? "Ask Jeeves warns of wider loss; CEO resigns - CNET News".

I think that answers my question.

Thursday, 30 July 2009

S-O - 7 Today!

Possibly not. Despite the current climate, the Act is still blamed for costing Wall Street billions, with Hoover's noting as recently as 2008 that it was: "cooked up in the wake of accounting scandals earlier this decade, it has essentially killed the creation of new public companies in America, hamstrung the NYSE and Nasdaq (while making the London Stock Exchange rich), and cost US industry more than $200 billion by some estimates."

Lucas spins right round

As the attacks on the bank pour in from publications both thoughtful (Rolling Stone) and wild-eyed (Wall Street Journal), van Praag is working double-time to keep the critics in line.

Not surprising then, that he may have appeared to contradict himself on occasion, as he tries to explain why Goldman is not actually to blame for everything from swine flu to global warming.

Sometimes, in trying to explain the unique culture of the bank which makes it so successful (it's definitely the "culture", not the government bailouts) he describes a place where ideas spring forth from bright individuals who are encouraged to speak out:

"In some other firms, nobody disagrees with the boss. Lloyd Blankfein would say that's not a luxury he enjoys," he offers to The Daily Telegraph.

On other occasions, he reckons instead that the secret is the fact that Goldmonites are a bunch of drones who all think and act alike.

"The cult of the individual, which I think has been a disadvantage to so many of the firm's competitors, really doesn't exist here," he tries.

Well, which way round is it, old son?

Monday, 27 July 2009

Three years - loads of non-jobs - and counting

Current vacancies include:

Assistant Venue Project Manager;

Environmental Manager;

Lead Logistics Manager (Venues);

National Olympic Committee Continental Manager (Africa);

National Olympic Committee Continental Manager (Asia);

National Olympic Committee Continental Manager (Pan America);

Brand & Marketing Director;

Paralympic Sport Coordinator;

Arrivals and Departures Manager;

Financial Analyst - Finance and Reporting;

Management Accountant;

Venue Results Manager;

Spectator Services Staffing Manager, and;

Spectator Services Operations Manager.

Trebles all round!

Thursday, 23 July 2009

A message from SMS?

The man who led the floats of Debenhams and Sports Direct is said by some close to him to have itchy feet. Mackenzie Smith is best known for settling (and winning) an argument about a £200,000 bill with Sports Direct founder Mike Ashley over a game of spoof. Word is that he has been '"interviewing" and indeed, say spies, is "desperate to move on".

Merrill is such a mess, who can blame him? Developing...

Tuesday, 21 July 2009

Jezza gets a whack on the bonce

But today's piece in The Telegraph gets awfully close to reaching an actual conclusion on what to do with the banks.

"Let's please learn the lessons and break up these goliaths, rather than fiddling around with capital controls and reform to banking supervision. Bankers will always find a way around those constraints."

Blimey! Of course, few people will have managed to read that far, given how turgid is the rest of his shoot-me-now prose.

A missable offer

SlackBelly is somewhat ahead of the curve and will begin charging immediately*.

Sign up now for just £50 a month to continue receiving a daily (usually) snippet of semi-news/abuse.

*not really.

Monday, 20 July 2009

Sunday, 19 July 2009

Surveillance...

Wednesday, 15 July 2009

Warner reports that he still can't make up his mind

Musing on the massive Goldman Sachs second quarter profits and the bank's role in the financial crisis he offers: "It’s pointless to get into the debate over Goldman’s culpability in what happened."

Why is it pointless? Surely deciding if Goldman is culpable or not is central to any description of how the bank is doing.

Warner says Goldman "rightly or wrongly is judged to have contributed to the near collapse of the banking system and a deep recession in the real economy".

Well, which is it?

As usual, Warner doesn't know, and is too timid to even venture an opinion.

Update: for a more critical view of Goldman Sachs during the credit crisis, click here.

Tuesday, 14 July 2009

Newsnight high on OD?

It is rumoured that it will be rather a soft effort. Let's hope not.

Update: The rumours were (unsurpisingly) correct. So a coup for OD's PR man, Roland Rudd. Treble (vodkas) all round!

Breakingviews News

"Thomson Reuters, the financial information group, is in preliminary talks to buy Breakingviews.com," King reports, before adding: "Breakingviews.com is understood to have appointed Perella Weinberg Partners, the corporate boutique, to advise on a possible transaction".

Quite why (having spent a fortune developing an analysis service of its own) Thomson Reuters would want to buy one, is a question that remains unanswered. However, a small clue may be sitting on the blog of Thomson Reuters boss, Tom Glocer.

On it he lists his favourite online news sources and right behind the obligatory Reuters reference comes (you've guessed it) Breakingviews.

Friday, 10 July 2009

Breaking up at Breaking Views?

Perhaps my clever young friends at Alphaville would benefit from the expertise that Hugo Dixon and his rapidly changing team could bring them.

I think we should be told.

Nobody going for Gold

Here's Gillian Tett's new book on the credit crunch, Fool's Gold, which you can see is coming under economic pressure itself having been discounted just a couple of month's after the tome's glamorous launch party. Fortunately, Gillian still has her day job as a columnist on the Financial Times where she writes about the potential of the "current wave of extraordinary policy measures unleash[ing] a wild bout of inflation". Not in publishing, luv.

Here's Gillian Tett's new book on the credit crunch, Fool's Gold, which you can see is coming under economic pressure itself having been discounted just a couple of month's after the tome's glamorous launch party. Fortunately, Gillian still has her day job as a columnist on the Financial Times where she writes about the potential of the "current wave of extraordinary policy measures unleash[ing] a wild bout of inflation". Not in publishing, luv.

Thursday, 9 July 2009

Swine Flu latest

I hear that Sarah Witt, from the world desk, is the patient and that her hubbie (and fellow FT hack), Pedro Das Gupta, is also "unwell".

Tuesday, 7 July 2009

Auntie remains shy over corporate plugs

Martina Navratilova and Bjorn Borg were interviewed extensively and both were wearing very heavily-branded HSBC polo shirts. HSBC branding also featured elsewhere in the package, which was obviously prepared outside the BBC.

Was there an explanation that this was an external production (given Des Lynam no longer works for the Corporation)? Or even an acknowledgement that the content might even have been sponsored? Of course not.

Sunday, 5 July 2009

Surveillance...

He's been spotted (on numerous occasions) by the BBC cameras at Wimbledon over the past fortnight - and is there again today, enjoying the men's final.

In fact he's sitting just behind Pistol Pete Sampras.

Update: Speaking of Sampras, how did the BBC allow Nike to broadcast such a blatant advert within its coverage following yesterday's Wimbledon final? The public service broadcaster managed to get itself duped into running a short film called Fifteen Love - filmed entirely in the style of a Nike commercial - to "celebrate" Roger Federer's 15th Major victory. The sports stars "congratulating" Federer? Er, John McEnroe, Tiger Woods, Pistol Pete and Serena Williams - all long-standing and high profile members of the Nike sales force. Solid work.

Wednesday, 1 July 2009

Bowker bows out

D'oh! Not any more. One day later and Bowker had resigned (for "a high-profile job overseas") - while ECML became the latest asset to be swallowed by the UK's sovereign wealth (sic) fund.

Monday, 29 June 2009

Feast of Stephen to end in famine?

Friday, 26 June 2009

BGC calls City hacks to lay

Maggie Pagano - Independent on Sunday 4/1

Louise Armitstead – Daily Telegraph 4/1

Danny Fortson – Sunday Times 5/1

Jenny Davey – Sunday Times 6/1

Richard Wachman – Observer 7/1

I'd lay the lot (in a betting sense). Not one has made the Telegraph's short list.

Tuesday, 23 June 2009

No respite for Horlick despite running Miles

The £20,000-a-week story-killer was brought in by beleaguered fund manager and so-called Supermum, Nicola Horlick, to stem the torrent of hostile newspaper coverage about her battle with property tycoon Vincent Tchenguiz (who objected to losing £15m of the £40m he'd invested with her).

Sadly for Nicko (whose vast girth makes even La Horlick appear svelte) his appointment has failed to halt the bad publicity - which seems to have developed from torrent to deluge. Still, he can claim one success: despite all the other financial pages covering the story ad nauseam, the Guardian has not seen fit to mention it once.

Monday, 22 June 2009

Carnaby goes all the way home

Obviously, the jokes are almost too easy although (clearly) I wish him well.

Wednesday, 17 June 2009

Fancy that...

November 1993: "These are tricky times for students at Balliol College, Oxford, bastion of liberal values for more than 700 years. The problem is tampons. Undergraduates have voted to pay a 'Tampax tax' to provide women at the mixed college with free sanitary protection. The tax was proposed by Kitty Ussher, a PPE student and women's group member, who said women were 'economically disadvantaged by a biological necessity'." Source: Observer.

Tuesday, 16 June 2009

Mystery Barclays payment leaves us feeling a little Green

Sir Philip Green, the feisty retailer behind Top Man, also got £12 million, I am told.

Staveley, you will recall, is the former girlfriend of Prince Andrew who nearly went bankrupt before establishing a career as a fixer.

She got £40m for helping line up a £7bn cash injection by Sheikh Mansour bin Zayed al Nahyan.

If you ask Barclays about Sir Philip, they get sniffy and a little defensive. "We didn't give him any money," say the bankers.

The money isn't disclosed in the prospectus, so if this tale is true we must assume that it was paid by somebody else in the chain. Surely not?

Thursday, 11 June 2009

Warner homes in on tedious new challenge

He managed to make his Gorkana entry about his move even more boring than his wittering Outlook pieces. An achievement of sorts.

Some unkind wags reckon his arrival at the Telegraph could wipe out the entire uplift in circulation gained from the MPs expenses scandal - due to the number of readers who die from boredom. Surely not!

Tuesday, 9 June 2009

Hampshire could land Nicola in a right Horlicks

The Hampshire pension fund is the second largest shareholder in Bramdean Alternatives with a 19% stake -- behind Vincent Tchenguiz who has 28%.

Tchenguiz wants to axe the board and liquidate the fund. If Hampshire agree with him, that's probably curtains.

Bramdean also manages £25 million of Hampshire pension fund cash -- a mandate that could be under threat....

Monday, 8 June 2009

Nicola Horlick - an inspiration

Saturday, 6 June 2009

The Secrets of Steve Tappin

Tappin has been claiming via the online encyclopedia that he's a mentor to some of the top names in British business, including Sir Terry Leahy, John Connolly, and Andy Haste, posting: "Steve is a CEO confidant for some of the CEOs of major global corporations such as Tesco, Deloitte and RSA applying the Secrets of CEOs to global corporations".

Oh really?

Tesco clarifies: "Sir Terry was interviewed last year for a book co-authored by Steve and Andrew Cave called The Secrets of CEOs. I am not aware of any other connection between the two."

RSA adds: "I can confirm that Andy Haste has not hired Steve Tappin, or anyone else, as a mentor," while Deloitte simply refuses to comment.

Strangely, after I raise this, Tappin's Wikipedia entry miraculously changes.

It now reads: "Steve is a CEO confidant for some of the CEOs of major global corporations. He is actively involved in many of top performing global businesses such as Tesco, Deloitte and RSA applying the Secrets of CEOs.”

Which is quite different.

Thursday, 4 June 2009

Horlick concentrates on hubbie's career

On June 13th, just days before the crucial EGM called by her client, shareholder and landlord, Vincent Tchenguiz, at which he hopes to oust the board and liquidate her Bramdean Alternatives fund, the couple are off to the Althorp Literary festival.

There they will perform their unusual "In Conversation" double act. What's more they've been invited up to the Big House to entertain the Earl himself. A potential bidder for Bramdean?

Wednesday, 3 June 2009

George leaves them wanting more

Treffers, you'll recall, once hilariously infuriated SNP leader Alex Salmond by suggesting that the UK give Scotland (instead of Gibraltar) to Spain. But among his other famous gems was, in 2004, accusing a string of "lazy, middle-aged" Tory MPs of hogging safe seats which should have been given over to the next Conservative generation.

There were just a couple of small flaws with the bed-blocking examples used in George's lucid argument, as two of those charged of idleness had an excuse for their Commons absence. They had recently undergone major heart surgery!

Tuesday, 2 June 2009

Here's real recycling for you...

"Stuart Rose, the chief executive of Marks & Spencer, who is spearheading a £200m plan to reinvent M&S as one of the UK's greenest companies, has been driving gas-guzzling Bentleys on his days away from the office. Mr Rose told journalists he was ordering an environmentally friendly hydrogen-powered BMW for his own use when he introduced the green initiative this year. But, the Guardian has learned, he has owned two Bentleys for the past year." Guardian/Observer, April 9, 2007.

"Before I leave, Rose tells me he needs to make 'an honest confession'. He looks slightly uncomfortable and starts shuffling papers on the table in front of him. 'I haven't told you a lie,' he begins, hesitantly. 'I have sold my Bentley, but I bought another one. But I only drive it on Saturdays and Sundays and it doesn't do more than about 8,000 miles a year, but it is my little indulgence. I wouldn't want you to think that I'd misled you'." Guardian/Observer,May 31, 2009.

Monday, 1 June 2009

Flipping Balls

The Schools Secretary - and his Housing Minister wife Yvette Cooper - first caught the attention of Channel Four Dispatches back in 2007 for repeatedly "flipping" their main residence between Yorkshire to London and claiming £27,000 subsidy on the £438,000 mortgage on their "second home" in Stoke Newington. That's despite their children attending local north London schools (while I'm willing to bet that their "first home" mortgage is also considerably lower).

The case for the Balls and Cooper defence back then? "They do consider Yorkshire to be their main family home but they are ministers and do not want to be apart from their children. They can nominate their London home as their second home."

That's all right, then.

Thursday, 28 May 2009

George moves Beyond Petroleum

Lord knows what he's up to next, but the move feels a touch rushed as I sense Treffers never quite fulfilled his potential at BP - at least in comedy terms.

Browne's monologues rarely contained the incendiary gags for which his speech writer was infamous (if you exclude that appearance in front of the Judge, of course), and City historians will surely conclude the Peer's straight delivery was an opportunity missed.

Trefgarne, of course, once infuriated a well known sports chain by implying the retailer only sold its wares to drug dealers, while, during a debate over the future of Gibraltar, he suggested England keep the Rock and give the Spanish Scotland instead. Unlike the rest of us, SNP leader Alex Salmond was not amused.

Wednesday, 27 May 2009

Kleinman v Peston scoop-match to begin

First comes confirmation that my tale was spot on (I can confound my critics - occasionally), while the channel also announced that long-standing business editor Michael Wilson is to leave.

All great stuff for viewers of the internal Sky soap opera, of course, but a question occurs.

Sky hopes that signing Kleinman might prevent it being so comprehensively outgunned by the BBC's Robert Peston - who is credited with virtually every major scoop of the credit crisis, supposedly gleaned from his legendary Treasury contacts.

Conversely, Kleinman's great skill is breaking corporate scoops. But will an exclusive about a massive rights issue carry the main bulletins quite as well as Pesto's Whitehall bombshells?