Thursday, 28 October 2010

Pure agony

Tuesday, 4 May 2010

City Index joins GC-H creditor queue

Geoffrey Conway-Henderson (crazy name, really crazy guy) was one of the first people hired by Michael Spencer, the founder of interdealer broker ICAP, when he was setting up the business. So one can assume he trousered a few sovs during his career.

Sadly, GC-H seems to have given most of it back to Spencer via City Index, the spread betting business the Tory treasurer also set up.

Two: If even City "experts" like Conway-Henderson can lose their shirt (if not all of their names) spread betting really is very risky. Like the ads say, you may lose more than your initial stake...

Tuesday, 6 April 2010

Kyle MacLachlan gets his finance lines wrong

For reasons quite unfathomable, Kyle MacLachlan - the actor who female readers may have watched in television's Sex and the City and Desperate Housewives - has been talking to the Telegraph about personal finance.

He says: "My first professional acting job earned me $550 – it was a Shakespeare festival in Oregon. I shared a house with three other people for $97 so we lived pretty well, all things considered. Nowadays, I'm much less of a spendthrift – I get it and spend it, so I have to keep working!"

I wouldn't expect a small screen American actor to know that the word 'spendthrift' means someone who is profligate, not parsimonious, but surely Telegraph sub-editors (even the ones now located in Australia to save costs) should know better?

It wasn't that long ago that the whole of the newspaper's staff received a Christmas bollocking on this very subject from associate editor, Simon Heffer. As the Heff lectured: "If you don't know what a word means it is generally a good idea not to use it until you have found out". He might have a point.

Thursday, 11 February 2010

Mousetrap

Tuesday, 19 January 2010

Pedants' corner...

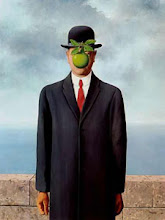

Today The Times and The Telegraph both tip their bowlers to Rolling Stone magazine, referring to Goldman Sachs as being a "giant vampire squid".

Just one problem. The actual words used in the famous piece by Matt Taibbi were: "great vampire squid".

City journalists should find the time to read him. The boy can write.

Tuesday, 20 October 2009

Fancy that...

"Nothing would be more futile than unilaterally to impose a windfall profits tax on bankers" - Daily Telegraph, B5, October 20, 2009.

Wednesday, 16 September 2009

Oh FT - no comment

TEB has started a new feature called Lex Watch which seems to be designed solely to slate the Pink 'Un's back page comment section.

He writes: "The Financial Times Lex column was once thought provoking, informative, and occasionally witty. Now it is lazy warmed-over, regurgitant, boring, with a narcissistic emphasis on style wrapped around flabby content – or am I just having a bad day?"

It seems not - as he's followed it up with a couple more scathing Lex postings, making my obsession with the Telegraph's Jeremy Warner seem positively healthy.

Tuesday, 21 July 2009

Jezza gets a whack on the bonce

But today's piece in The Telegraph gets awfully close to reaching an actual conclusion on what to do with the banks.

"Let's please learn the lessons and break up these goliaths, rather than fiddling around with capital controls and reform to banking supervision. Bankers will always find a way around those constraints."

Blimey! Of course, few people will have managed to read that far, given how turgid is the rest of his shoot-me-now prose.

Wednesday, 15 July 2009

Warner reports that he still can't make up his mind

Musing on the massive Goldman Sachs second quarter profits and the bank's role in the financial crisis he offers: "It’s pointless to get into the debate over Goldman’s culpability in what happened."

Why is it pointless? Surely deciding if Goldman is culpable or not is central to any description of how the bank is doing.

Warner says Goldman "rightly or wrongly is judged to have contributed to the near collapse of the banking system and a deep recession in the real economy".

Well, which is it?

As usual, Warner doesn't know, and is too timid to even venture an opinion.

Update: for a more critical view of Goldman Sachs during the credit crisis, click here.

Thursday, 11 June 2009

Warner homes in on tedious new challenge

He managed to make his Gorkana entry about his move even more boring than his wittering Outlook pieces. An achievement of sorts.

Some unkind wags reckon his arrival at the Telegraph could wipe out the entire uplift in circulation gained from the MPs expenses scandal - due to the number of readers who die from boredom. Surely not!

Tuesday, 28 April 2009

How (modern) market reporting works - part 2 ...

The big-hitting broker has cut the rating on Sir Martin Sorrell's company from buy to hold and slashed its price target from 552p to 440p.

WPP's shares dropped 6p to 397 1/2p in a widely higher London market after analysts said that the seasonal nature of the business, with the last three months of its year proving its most profitable thanks to a Christmas advertising rush, means it no longer thinks clients should snap up the stock." - Evening Standard market report, Monday March 23.

"Advertising giant WPP was one of the biggest losers after Citigroup warned that now is not the time to buy.

The heavyweight broker cut its rating on Sir Martin Sorrell's company from buy to hold and slashed its price target from 552p to 440p.

Citigroup analysts argued that now is not the time to buy the company's shares because of the seasonal nature of the business, with the last three months of its year proving its most profitable thanks to a Christmas advertising rush.

WPP shares shed 33/4p." - Daily Telegraph market report, Tuesday March 24.

Friday, 17 April 2009

How (modern) market reporting works...

"In fact, cash-strapped Barclays climbed above 200p for the first time since October" - Daily Telegraph market report, Friday April 17.

Wednesday, 15 April 2009

Time to warm up the subs at the Tel?

So there's more ammo, it seems, for those churlish souls who insist that standards have slipped at the once great rag (which now outsources some of its sub-editing to, er, Australia).

Tuesday, 31 March 2009

Breaking media news...

Friday, 20 March 2009

Collins reaches out for new opportunity

After twenty years duffing up chief executives as City editor of the Daily Telegraph, and a few more writing a punchy column at the Evening Standard, Collins knew to expect a few hits back.

He is, as they say, available for hire. Might fresh opportunities present themselves in some of Collins's pet areas - such as our economy's only growth sector?