Wednesday, 22 December 2010

Brass monkey Britain, part 1894...

Tuesday, 21 December 2010

Quote of the week

Monday, 20 December 2010

Bad bet

Tuesday, 14 December 2010

Thoroughbred float quickly looks like an old nag

Monday, 13 December 2010

Clip of the week

Saturday, 11 December 2010

Orange out of order

Wednesday, 8 December 2010

Fancy that!

Tuesday, 7 December 2010

The future's not Orange

Monday, 6 December 2010

Murray Pru bound

Murray has been hired to fill the shoes of the recently departed Stephen Whitehead. Some say the men are in some ways similar.

The new man, a titan of a journalist during his career at the Express, is just what the Pru needs. Of course, like all the best journalists he has been in public relations for some time.

Murrary's last job was at the FSA, where he led the PR department through the financial crisis.

The regulator did not put a single foot wrong during this period - which is no doubt a considerable comfort for the insurer as it battles to restore its reputation in the wake of the botched $35 billion bid for AIA.

Sindy Column...

Tuesday, 30 November 2010

Academic push-up for Mone

Another week, another insecure tycoon feels the need to paper over a lack of academic qualifications by accepting an honorary degree (either the height of vanity or a begging letter – depending on if you’re giving or receiving).

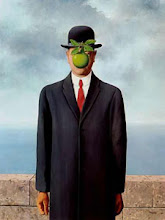

This time University of Hertfordshire (Hatfield Technical College, as was) has doled out the award to Ultimo bra founder, Michelle Mone (possibly pictured below in the outfit she chose to receive the Chancellor).

Mone left school at 15 (to help support her ill father) but snubbing academia didn’t overly hinder her as she’s now supposed to be worth about £45m. Also receiving a gong was Tesco’s clothing boss, Terry Green. Sadly, there’s no room for a snap of him sporting the supermarket’s trolleys.

Monday, 29 November 2010

Sindy Column...

Thursday, 25 November 2010

Former BP man to go green?

Tuesday, 23 November 2010

Kill Phil

Monday, 22 November 2010

Thursday, 18 November 2010

Everybody needs good neighbours

Tuesday, 16 November 2010

Fate tempting

Monday, 15 November 2010

Wednesday, 10 November 2010

Beyond Petroleum

Congratulations to Anthony Henshaw, who was named on Friday as the new chief sustainability officer (whatever that is) of controversial Indian mining group, Vedanta Resources. He might be busy, as the company is no stranger to the odd run-in with human rights campaigners and environmental groups, but Henshaw sounds experienced enough as the press release states he’s spent 30 years in the cement, oil and gas industries while naming his previous employer as buildings material group, Cemex.

When pushed, the company’s spinners add oil and gas groups Cuiaba and Transredes to Henshaw’s CV, but strangely they omit to mention the place where he worked in his last job but one. That would be BP, where he was involved in formulating “oil spill response” plans. Why omit that detail, I wonder?

Monday, 8 November 2010

Shooting the messenger

Thursday, 4 November 2010

Our survey said...

Tuesday, 2 November 2010

MCC steals a cheeky single

Monday, 1 November 2010

Yu done it

Instead, the company always claimed to be a technology platform, which high street bookies say allows Betfair to pay "around three times less in tax and levy than traditional UK bookmakers".

Their lobbyists have all noticed this cock-up and are anxiously exploring ways to convert this open goal into a taxation victory. In fact, William Hill has just put out a press release on the Yu interview. It's title? "Betfair's Identity Crisis - just who are Yu, David?"

Very droll.

Thursday, 28 October 2010

Pure agony

Monday, 25 October 2010

Wednesday, 20 October 2010

Salmon leaps up Spreadex ladder

"Tom Salmon has taken up the role at the age of just 25 after impressing during his four years with the firm.

Spreadex Managing Director Jonathan Hufford said: 'We like to think of ourselves as a forward thinking company and are keen to promote people to positions of responsibility when they have proved their worth, no

matter what their age.' Tom is originally from Blackpool and studied maths at Manchester University, where he specialised in applied maths."

Young maths geek in charge? There are literally no recorded examples of this ever going wrong.

Tuesday, 19 October 2010

Vexed and the City

Monday, 18 October 2010

Man off wire

Sindy Column...

Thursday, 14 October 2010

They think it's all over?

Monday, 11 October 2010

Meltdown the sequel

Wednesday, 6 October 2010

Second inaugural profit at City AM?

Tuesday, 5 October 2010

Trump on the stump?

My old friend, comb-over king Donald Trump, says he's considering running for President after some poll was apparently conducted in New Hampshire testing out his name.

My bet is this is a publicity stunt for some television show or new business, but I'm half hoping it's real - it will be an absolute hoot!

As I occasionally enjoy pointing out, the Donald's views on the Italians and Chinese are somewhat uncompromising (so foreign policy should be interesting), while I particularly look forward to him courting the female vote, where he's shown some form before.

In January last year after the death of John Travolta and Kelly Preston's son, Jett, Trump paid tribute to the family by blogging how he once tried to bed the mother of the dead boy.

"My track record on this subject has always been outstanding, but Kelly wouldn’t give me the time of day," he movingly recalled at the time. Can the Donald really be the Republicans' Trump card?

Monday, 4 October 2010

Friday, 1 October 2010

Ryder in a storm

"We have a weather expert able to comment/predict on the weather," it begins as play in Wales is interrupted by torrential rain. "Dr Liz Bentley is one of the world’s leading weather experts. Former Chief Instructor of Forecasting at the Met Office College, she is the ultimate weather woman and climate change forecaster. Liz was BBC Weather Centre Manager before taking up the post of Head of Communications at the Royal Meteorological Society, when she founded the public membership organisation theWeather Club, in 2010, to promote an appreciation and understanding of the weather to people from all walks of life."

All very impressive. Just one question. If she's so good, why wasn't the plug sent yesterday?

Thursday, 30 September 2010

How the business of football works

Tuesday, 28 September 2010

Trump hump

Monday, 27 September 2010

Thursday, 23 September 2010

The Warren Omission

A Cable Fable

Monday, 20 September 2010

Thursday, 16 September 2010

Devilfish needs a re-buy

Tuesday, 14 September 2010

Accounting for growth

Monday, 13 September 2010

Wednesday, 8 September 2010

Surveillance...

Tuesday, 7 September 2010

Figure watching...

£34,766.53 - the value of that stake before Connaught shares were suspended today.

Monday, 6 September 2010

Friday, 3 September 2010

Wall Street Journal axes important letters

Tuesday, 31 August 2010

Slack on the back

The company, which operates in Italy, Spain, Portugal, South Africa and the UK, had been exploring a float or sale to a private-equity firm. Insiders suggested the sale talks are also on ice although some observers believe a deal could yet be revived." Sunday Times, August 29, 2010.

Sindy column... (belatedly)

These loans are common enough in the City as an alternative bonus payment and are “forgivable” in the sense that if you work for a company for an agreed period, then they get written off. If you want to leave before you’ve served your time, however, then you have to repay the lot, and the loans are seen by many as a cunning, even draconian, method of staff retention. Cantor, which is led by Howard Lutnick (above) has the reputation of being more attached to this tactic than most.

Still, court documents show that Koskas did trouser the cash, handed in his notice before working the agreed three-year period, and has so far failed to repay his former employer. His defence revolves around restraint of trade and technicalities regarding his February resignation.

Chris McGrath, the lawyer defending Koskas and a longstanding adversary of Cantor, declines to comment on the case - as does the broker itself. So I’ll take a wild punt and guess that this case will end up being settled, adding more weight to the oft-used line about legal departments at broking firms: they are profit centres.

WHAT news of Andrew Greystoke, the Atlantic Law founder and solicitor who was banned for life from the City in May for his role in assisting share pedlars to rip off at least 130 people in a “boiler-room” scam?

That punishment from the FSA also prompted the Solicitors Regulation Authority to institute disciplinary proceedings against him - but the body seems to be taking its time as Greystoke (right) is still listed as a solicitor. He’s also quietly changed the name of his firm to Stanwick & Bond (although it’s yet to be registered with the Law Society).

“Andrew Greystoke is not back in the office until next week,” blocks one Julian at S&B - who refuses to reveal his own surname. “We are not at liberty to discuss with you when we changed our name”.

Still, despite not taking any action thus far, the SRA insists: “We have him in our sights.”

GREYSTOKE was also once a director and major shareholder in First London Securities, the defunct investment bank that attracted attention last year due to its links with a convicted insurance fraudster and its role in the short-lived takeover of Notts County, the Football League’s oldest team.

The bank also boasted former Conservative environment minister Tim Yeo and Nicholas Chance, Prince Michael of Kent’s private secretary, as directors, while a former shareholder was one-time Jersey bankrupt Kevin Leech.

Leech, I note, has just resigned from the board of Devilfish, a listed poker group, on the grounds of ill-health. I’m told the 67-year-old is suffering from high blood pressure, which has prompted doctors to instruct him to retire. Associates are sceptical that the old rascal will obey the orders for long, however.

THE return of Polly Peck boss Asil Nadir just about gives me enough of an excuse to retell a witty observation about the old fugitive. David Stoddart, highly regarded retail analyst at finnCap, and former Polly Peck worker, once recalled: “It was the only company I’ve ever been at where the fixtures and fittings appreciated.”

PROPERTY industry aficionados will know that O’Callaghan Properties scooped £48m last week by selling 20 Grafton Street to a “private German investor”, in one of the priciest office deals in the West End this year. So who was the mysterious buyer?

Step forward Baron August von Finck Jnr, one of Germany’s richest men. Forbes estimates he is worth £5bn. His family trust has interests in property around Munich, a shareholding in hotel group Mövenpick, and stakes in fast-food chains. Still, much of the wealth originates from great-grandfather Wilhelm von Finck, who founded insurance giant Allianz and private bank Merck Finck & Co.

The bank was then expanded by Baron August von Finck Snr - a controversial figure as a leading Nazi supporter and one of a group of industrialists who met Hitler in 1931 and promised financial support in the event of a successful putsch against the Weimar Republic.

Von Finck Jnr (above) sold Merck Finck to Barclays in the 1990s. Isn’t life grand?

COMB-OVER king Donald Trump does not like the Chinese at all. He blogs: “From the gymnasts caught cheating at the Olympics to the singer caught lip-synching on international television, I don’t have the highest esteem for their ethics. It’s all a charade. I also don’t like the fact that we look like fools. I know for a fact they laugh at the stupidity of our leaders, and for good reason. They can’t believe they’re getting away with what they’re getting away with and we’re allowing it.”

Simultaneously, bosses at Aberdeen Airport say they are in talks with Chinese airlines about new services to the Granite City. Their big selling point? The new £750m Balmedie golf resort being built by, er, Donald Trump.

FOLLOWING my story that Red Molotov, the T-shirt firm, was selling designs featuring the BBC’s Robert Peston (below) comes another business-inspired garment.

The craggy features of Duncan Bannatyne, star of the BBC’s Dragons’ Den, can now be enjoyed by T-shirt wearers. The marketing bumf reads: “Everyone’s favourite Dragon. Well, apart from Peter Jones maybe. And that James Caan seems a nice bloke. Deborah Meaden frankly scares us though.” The shirt itself reads: “I don’t like the product, I don’t think it would sell, it’s not a viable business, and I’m not so keen on you ... and ... I’M OUT!” I’m sure it’s ironic.

HAS Gordon Gekko gone out to lunch at last? The initial online reviews for Money Never Sleeps, the soon-to-be-released sequel to Oliver Stone’s Wall Street, starring Carey Mulligan and Shia LaBeouf beside Michael Douglas (above), have been pretty positive. But might the studio be controlling things a little? My man at an early viewing reckons Gordon Gekko’s latest showcase has “lost its edge”, with many “punch lines coming from the old film”. Who’d have thought it?

Friday, 27 August 2010

Tuesday, 24 August 2010

Bennett caught short in drugs bust

Former Sunday Telegraph City Ed turned City spinner, Neil Bennett, has had a run in with a team of rozzers, I am delighted to report. On his Facebook page, Bennett writes: “I am shocked to announce I have had a brush with the law, a drugs bust no less. Shocker. It was at Redhill station where I got off the train bursting for the loo. As I searched I was collared by a plain clothes copper. Apparently I had avoided a police check and needed to be frisked for crack. There were at least a dozen coppers in this ridiculous exercise - do they really have nothing better to do”

Monday, 23 August 2010

Sindy column...

August 22, 2010

SPECULATION that Betfair is on the verge of floating has been around for years, but the last whispers emanating from the online betting exchange’s advisers suggested everything could kick off as early as next month.

Want to bet? Sources close to the company now reckon that market conditions make that plan look increasingly ambitious and, in any case, I hear that finance director Stephen Morana is currently away on a long honeymoon while chief exec David Yu, chairman Ed Wray and a host of others are off on their summer holidays.

Furthermore, interviews for the group’s new head of communications continue next week – presumably to find a person to help talk up the company’s shares. That would leave the new spinner with a tight timeframe to work their notice, arrive and settle in before a September listing.

Developing, as they say.

IN MARCH, Cable & Wireless split into two separate businesses: Cable & Wireless Worldwide and Cable & Wireless Communications. Shareholders were given one share in each, with Worldwide remaining in the FTSE 100 and Communications joining the FTSE 250.

This thrilled Worldwide boss John Pluthero, who could barely resist an opportunity to wind up his former colleagues about the respective valuations. Since then, the share price of Communications has edged up very slightly, while Pluthero’s Worldwide has been forced to issue a profits warning and seen its market cap slump to the same size as its smaller sibling. It now faces almost certain relegation to the FTSE 250.

Who’s laughing now, John?

Q: Who, in 2009, said: "To be the chairman of a FTSE company, you have got to have built a reputation over 30 years. Given the current extreme volatility and difficult economic conditions, you potentially put all that at risk in a business that is bound to be different from that in which you spent your working life.''?

A: Robert Swannell, the banker who is to become the, er, next Marks & Spencer chairman.

ON August 10, investment manager Baillie Gifford decided to sell shares in Cairn Energy – triggering a stock exchange announcement that its stake had dipped below 5%. It won’t say how many it sold, which is perhaps not too surprising. Six days later Cairn shares shot up by 5%, as the company announced it would net up to £6bn by flogging most of its stake in Cairn India to miner Vedanta. A chunk of the proceeds will also be returned directly to shareholders.

A trifle embarrassing for Baillie, perhaps, as well as for Iain McLaren. He sits on the board of Baillie Gifford and Cairn Energy. It shows Chinese walls work, I suppose.