BP's embarrassing windfalls

BP shareholders have watched the value of their investment slump by a third since the leak in the Gulf of Mexico. But some canny investors saw significant profits before disaster struck.

Who were these prophets? Step forward BP chief exec, Tony Hayward, and Andy Inglis, boss of exploration and production, who respectively trousered £1.4m and £498,000 via share sales in March, just a month before the blast that killed 11 workers and triggered environmental catastrophe. I wonder if the pair might make a magnanimous gesture and donate their profits to charities helping the local flora and fauna get their lives back?

"Ha!" said a BP spokesman, before composing himself: "Er, erm ... I'll get back to you." Like a Gulf of Mexico solution: still waiting.

A deafening silence

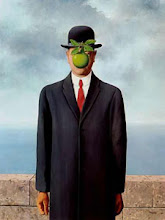

Ocado, the unprofitable soon-to-be-floated online retailer co-founded by ex-banker Jason Gissing, right, has hired UBS, JP Morgan Cazenove, HSBC, Barclays, Lloyds Banking Group, Numis, Jefferies and Goldman Sachs to assist. Might handing so many banks a slice of the pie come with a price - i.e., no heckling about the float from their analysts? "I think there are a few more analysts around than just those at these banks," blocks a mouthpiece. Possibly, but the tactic seemed to work on the laughable Prudential rights issue, which boasted a team sheet that read like the Who's Who of investment banking. Coincidentally, it attracted virtually no objective comment by their biddable analysts.

A Wanless wonder

Sir Derek Wanless defiantly refuses to allow career embarrassments keep him out of the public eye. Having spent the credit crisis as the head of Northern Rock's risk committee, he followed that triumph by accepting pointless honorary degrees from former polys before moving to the speaking circuit. His latest appearance came last week at Durham University, during a seminar on water. Has the man no shame?

Music, maestro!

For 20 years, Nigel Brown, the founder of NW Brown Group, has been supporting promising musicians by forming syndicates to buy them instruments - which they can then buy for themselves during the span of their careers.

These are decent - tax efficient - investments, as these rare instruments tend only to rise in value ("Antonio Stradivari has given me an undertaking not to make any more," says Brown). If you want to hear how they sound, pop along to Cambridge's West Road Concert Hall on 14 June, when the businessman is staging a concert featuring his prodigies. They include Natalie Clein, pictured, the cellist and former Young Musician of the Year. Nigel Kennedy was also given a boost by these syndicates, but let's not hold that totally against Brown.

3 comments:

A Wanless wonder !

Has a single banker yet uttered one word of mea culpa ? Despite all the 'get tough' rhetoric from the Government, has a single banker sufferred from any firm of sanction ? You mention Sir Derek Wanless, the disgraced Head of Risk at Northern Rock. I see that he still holds his seat on the Government's Board for Actuarial Standards, part of the FRC. Wanless is surely the very antithesis of actuarial prudence. Let us just accept that the ordinary Joe will end up paying for this financial mess, whilst life for the culpable bankers like Wanless will just go much as normal. If all else fails, they always their multi-million pound 'rewards for failure' to fall back on.

Obviously the last thing I want to do is stick up for Sir Del, but I think the Board for Actuarial Standards is funded by industry - not the Government.

Slack - You will find that the BAS (part of the FRC) is part funded by the Depart of BIS, and appointments are made by the Secretary of State, formerly Lord Mandelson, now Dr Vince Cable. Industry does make some contribution, hence, you would think they might question why Wanless, as the proven antithesis of actuarial prudence is setting their standards ! Perhaps the answer is to get rid of the BAS altogether as part of the cull of

quangos and NGO's. I can't think of a better place to start.

Post a Comment