Mark Davies - managing director of betting exchange Betfair and son of footy commentator Barry - dismisses stories that the company has just appointed Rothschild to advise on a flotation.

“It's just not true,” Davies insists to the Evening Standard's City Spy column. “Speculation about a flotation comes up regularly. But we are not about to appoint an adviser.”

The freesheet seems sceptical about that response - and so it should be. What Davies fails to mention is that Goldman Sachs has already been asked by the betting group to handle the £1.5bn listing, while Credit Suisse has also been handed a spot in the starting XI.

Monday, 30 November 2009

Thursday, 26 November 2009

Bolton wanders east

Superstar fund manager, Anthony Bolton, is back.

The former Fidelity stock picker is setting up a China-focused fund and will relocate from London to Hong Kong.

Bolton stepped down as manager of Fidelity's Special Situations Fund at the end of 2007 – having run it brilliantly since 1979 – and it was subsequently split in two.

Sanjeev Shah took on the UK Special Situations Fund (which has performed very well), while Jorma Korhonen looks after international holdings in Global Special Situations Fund – which is down since inception (although up nicely this year). So, might the return of Bolton, and the launch of another international fund, put a bit of extra pressure on his former prodigy, Korhonen?

If it does, he has Mrs Bolton to thank. The veteran fund manager mentioned to his missus that he missed running money and fancied creating an Asia fund. She replied: "Why don't you, then?"

The former Fidelity stock picker is setting up a China-focused fund and will relocate from London to Hong Kong.

Bolton stepped down as manager of Fidelity's Special Situations Fund at the end of 2007 – having run it brilliantly since 1979 – and it was subsequently split in two.

Sanjeev Shah took on the UK Special Situations Fund (which has performed very well), while Jorma Korhonen looks after international holdings in Global Special Situations Fund – which is down since inception (although up nicely this year). So, might the return of Bolton, and the launch of another international fund, put a bit of extra pressure on his former prodigy, Korhonen?

If it does, he has Mrs Bolton to thank. The veteran fund manager mentioned to his missus that he missed running money and fancied creating an Asia fund. She replied: "Why don't you, then?"

Wednesday, 25 November 2009

Dispatching Deripaska

Oleg Deripaska is set to lose control of aluminium giant Rusal. That's not all that Russia's former richest man has little power over.

Channel 4's Dispatches is set to broadcast an investigation into a cast of our Russian friends next week - entitled Lords, Billionaires and the Russian Connection. It is not expected to be especially complimentary to either Deripaska, or wannabe Arsenal owner, Alisher Usmanov.

Channel 4's Dispatches is set to broadcast an investigation into a cast of our Russian friends next week - entitled Lords, Billionaires and the Russian Connection. It is not expected to be especially complimentary to either Deripaska, or wannabe Arsenal owner, Alisher Usmanov.

Labels:

Alisher Usamanov,

Channel 4,

Dispatches,

Oleg Deripaska,

Rusal

Tuesday, 24 November 2009

A turn up for the books

I see William Hill FD, Simon Lane, has left the bookmaker just a few weeks after its bond issue.

That's a nice touch. Presumably the decision to part company must have been made in the past few days, otherwise I'm sure the company would have let investors know about the switch when making representations during the fundraising.

Update 24/11/09, 15:10: Simon Lane attended the bond presentations yet failed to mention his job move. Says one investor: "They should really have delayed the process until they had a new finance director. He didn't answer many questions and didn't give out his [business] card." Shoddy.

That's a nice touch. Presumably the decision to part company must have been made in the past few days, otherwise I'm sure the company would have let investors know about the switch when making representations during the fundraising.

Update 24/11/09, 15:10: Simon Lane attended the bond presentations yet failed to mention his job move. Says one investor: "They should really have delayed the process until they had a new finance director. He didn't answer many questions and didn't give out his [business] card." Shoddy.

Labels:

bond market,

finance director,

Simon Lane,

William Hill

Friday, 20 November 2009

Dumbing down

Overheard in a Mayfair bar:

Pinstriped boozer: Hedge fund management is hardly rocket science, is it?

Hedge fund manager: No - and I should know. I used to be a rocket scientist.

(Dumbing down is an occasional series dedicated to people forced to take jobs below their capabilities.)

Pinstriped boozer: Hedge fund management is hardly rocket science, is it?

Hedge fund manager: No - and I should know. I used to be a rocket scientist.

(Dumbing down is an occasional series dedicated to people forced to take jobs below their capabilities.)

Labels:

hedge fund,

rocket science

Thursday, 19 November 2009

Every title helps

I see that Tesco boss, Sir Terry Leahy, has become the latest businessman to accept an Honorary Degree - a pointless bauble that's either a) the height of vanity to accept or b) a shameless begging letter if you dole them out.

The retailer has been "honoured" by the University of Hertfordshire (Hatfield Poly as was) with a gong he can now add to the other honorary award he has from Cranfield University (formerly Cranfield Institute of Technology) - plus the 2:1 in management science he obtained from UMIST in 1977 when he actually had to pass a couple of exams.

This latest degree means Sir Terry joins a growing club of business knights who are rather partial to collecting these trinkets. Among their number is the great Sir Derek Wanless - who loves publicising awards from former Polytechnics yet doesn't like talking much about his time as head of Northern Rock's risk committee.

Why do these people do it?

The retailer has been "honoured" by the University of Hertfordshire (Hatfield Poly as was) with a gong he can now add to the other honorary award he has from Cranfield University (formerly Cranfield Institute of Technology) - plus the 2:1 in management science he obtained from UMIST in 1977 when he actually had to pass a couple of exams.

This latest degree means Sir Terry joins a growing club of business knights who are rather partial to collecting these trinkets. Among their number is the great Sir Derek Wanless - who loves publicising awards from former Polytechnics yet doesn't like talking much about his time as head of Northern Rock's risk committee.

Why do these people do it?

Wednesday, 18 November 2009

Fancy that...

"I love Morrisons, I am happy here" - WM Morrison chief exec, Marc Bolland, September 10, 2009.

"Marks & Spencer has confirmed it is appointing Morrisons boss Marc Bolland as its new chief executive" - November 17, 2009.

"Marks & Spencer has confirmed it is appointing Morrisons boss Marc Bolland as its new chief executive" - November 17, 2009.

Labels:

Marc Bolland,

Marks and Spencer,

Wm Morrison

Tuesday, 17 November 2009

Kafka on trial

Goldman Sachs's London spinmeister, Paul Kafka, is gamely persevering with his ambitious project designed to make his banking overlords appear more humane.

Vice chairman "Fat Mike" Sherwood - who likes to wear a personalised tracksuit while playing ping pong - used The Times's opinion pages last month to preach to ungrateful readers how Goldman's clients selflessly grow "the savings of millions of people".

Then chief exec Lloyd Blankfein joined the crusade, telling the Sunday Times how he and his disciples are merely performing "God's work".

And, today, the Holy Trinity was completed with chief economist, Jim O'Neill, popping in to give the economic sermon in the Evening Standard.

For some reason, Jim got slightly distracted and waffled on a touch about a trip to China with the missus, but was soon back on message to namecheck his ultimate master.

He argued the credit crisis was "an act of God" for China, before signing off with a quick "thank God for the English language".

After all that, any sane soul would now recognise it's time for Kafka to revert to type and impose a vow of silence. But, like much of his namesake Franz's work, City wags fear his shameless publicity project remains unfinished.

Vice chairman "Fat Mike" Sherwood - who likes to wear a personalised tracksuit while playing ping pong - used The Times's opinion pages last month to preach to ungrateful readers how Goldman's clients selflessly grow "the savings of millions of people".

Then chief exec Lloyd Blankfein joined the crusade, telling the Sunday Times how he and his disciples are merely performing "God's work".

And, today, the Holy Trinity was completed with chief economist, Jim O'Neill, popping in to give the economic sermon in the Evening Standard.

For some reason, Jim got slightly distracted and waffled on a touch about a trip to China with the missus, but was soon back on message to namecheck his ultimate master.

He argued the credit crisis was "an act of God" for China, before signing off with a quick "thank God for the English language".

After all that, any sane soul would now recognise it's time for Kafka to revert to type and impose a vow of silence. But, like much of his namesake Franz's work, City wags fear his shameless publicity project remains unfinished.

Monday, 16 November 2009

Question Thiam

A brave move from Prudential, which has allowed chief executive Tidjane Thiam to appear on the website of The Times as part of a feature called "Ask the Boss".

"You can ask the new man from the Pru anything you like" The Times tells its readers, which is a priceless opportunity that I've been waiting weeks to present itself.

My starter for TT: "Are you finding that your sexual allure has increased since you became chief executive?"

"You can ask the new man from the Pru anything you like" The Times tells its readers, which is a priceless opportunity that I've been waiting weeks to present itself.

My starter for TT: "Are you finding that your sexual allure has increased since you became chief executive?"

Labels:

Prudential,

the Times,

Tidjane Thiam

Wednesday, 11 November 2009

Surveillance...

Former billionaire, Robert Tchenguiz, with his wife and brood, on the Natural History Museum's merry-go-round on Sunday afternoon.

After the £4-a-pop spin finished, all riders disembarked, apart from Robbie -who proceeded to have another go. Not down to his last penny just yet, then.

Tuesday, 10 November 2009

A parable of our time

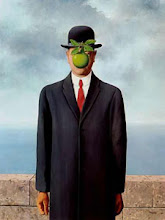

It would be churlish to allow the news that Goldman Sachs is busying itself doing "God's work" without marking the announcement with a new SlackBelly series celebrating the bank's legions of disciples as they go about their good deeds.

It would be churlish to allow the news that Goldman Sachs is busying itself doing "God's work" without marking the announcement with a new SlackBelly series celebrating the bank's legions of disciples as they go about their good deeds.To begin, here's a picture of Goldman Sachs International co-chief executive, "Fat Mike" Sherwood, putting in another shift for the Almighty at the ping pong table while wearing a tracksuit personalised with his own initials.

Fortuitously, this snap landed in my in-box just in time to be included in this feature - proving that there is a God who we can all work to please. He really does work in mysterious ways.

News of a GS banker? Please email the collection plate at postmaster@slackbelly.com.

Labels:

Fat Mike,

Goldman Sachs,

Michael Sherwood

Monday, 9 November 2009

Blankcheque threads his way through the eye of a needle

Goldman Sachs boss Lloyd Blankcheque says that he's doing "God's work" impersonating a great vampire squid. But which God?

Blankfein is, himself, Jewish, but is not adverse to schmoozing those with lines into the other major religious brands.

On Pope Benedict's trip to the US last year, His Excellency dropped in for the first ever papal visit to a US synagogue and met Jewish "leaders" including private-equity billionaire Stephen Schwarzman as well as the Goldman boss.

So, is Blankfein hedging his bets?

Blankfein is, himself, Jewish, but is not adverse to schmoozing those with lines into the other major religious brands.

On Pope Benedict's trip to the US last year, His Excellency dropped in for the first ever papal visit to a US synagogue and met Jewish "leaders" including private-equity billionaire Stephen Schwarzman as well as the Goldman boss.

So, is Blankfein hedging his bets?

Bookie wins shocker

I'm told that the William Hill £300m bond offer has got away...

Labels:

bond market,

William Hill

Friday, 6 November 2009

Blair watch project...

"Dear all, I have 4 tickets I'm looking to sell for England vs. Australia at Twickenham for £80 each," reads a round robin email just sent from Morgan Stanley's Global Capital Markets desk. "The seats are in 2 + 2 but are pretty close to each other. The match is tomorrow at 14.30 GMT. Please get back to me ASAP."

The sender? One Euan Blair - son of our glorious former Prime Minister and therefore the progeny of one of London's more opportunistic money-making couples. Who'd have thought it?

Update 09/11/09: Oh dear ... http://www.dailymail.co.uk/news/article-1226063/Euan-Blair-England-rugby-tickets-probe.html.

The sender? One Euan Blair - son of our glorious former Prime Minister and therefore the progeny of one of London's more opportunistic money-making couples. Who'd have thought it?

Update 09/11/09: Oh dear ... http://www.dailymail.co.uk/news/article-1226063/Euan-Blair-England-rugby-tickets-probe.html.

Labels:

Australia,

Cherie Blair,

England,

Euan Blair,

Morgan Stanley,

Prime Minister,

Tony Blair,

Twickenham

Media news...

How's Alan "Rubbisher" Rushbridger's dream of global web glory for The Guardian coming along?

The newspaper has just fired all of its local Washington reporters as part of a cost cutting drive, but perhaps that's just a, er, temporary setback.

The six staffers - all Americans recruited on short-term contracts to crack the US online market for the media group - got their marching orders yesterday, I understand.

The paper, and its sister The Observer, are now just going to have to make do with their old newspaper hacks, who never understood what those web people were doing in the first place...

The newspaper has just fired all of its local Washington reporters as part of a cost cutting drive, but perhaps that's just a, er, temporary setback.

The six staffers - all Americans recruited on short-term contracts to crack the US online market for the media group - got their marching orders yesterday, I understand.

The paper, and its sister The Observer, are now just going to have to make do with their old newspaper hacks, who never understood what those web people were doing in the first place...

Labels:

Alan Rushbridger,

The Guardian,

The Observer

Dual on the Hill

Readers of the newspapers' market reports this morning may have experienced something of a double take...

"I hear that the William Hill boys are out schmoozing the bond markets this week in an attempt to raise some cash for the embattled bookie. Apparently the presentation has been poorly received." - SlackBelly, Wednesday November 4, 2009.

"William Hill was under pressure amid chatter it is about to sell high yield bonds to help refinance its existing £1bn debt pile." - Daily Telegraph, Friday November 6, 2009.

"William Hill traded 2½p lower at 173¾p as the bookie’s presentations to the bond markets failed to capture the imagination. It is looking to raise as much as £250 million, partly to pay down debt." - The Times, Friday November 6, 2009.

"I hear that the William Hill boys are out schmoozing the bond markets this week in an attempt to raise some cash for the embattled bookie. Apparently the presentation has been poorly received." - SlackBelly, Wednesday November 4, 2009.

"William Hill was under pressure amid chatter it is about to sell high yield bonds to help refinance its existing £1bn debt pile." - Daily Telegraph, Friday November 6, 2009.

"William Hill traded 2½p lower at 173¾p as the bookie’s presentations to the bond markets failed to capture the imagination. It is looking to raise as much as £250 million, partly to pay down debt." - The Times, Friday November 6, 2009.

Labels:

bond market,

William Hill

Thursday, 5 November 2009

Spinning into trouble with a Greek bearing gifts

I read that the Chartered Institute of Public Relations is expecting to lose around £700,000 this year following an almighty cock-up during its move from swanky St James's Square to (equally plush) surroundings in Bloomsbury Square.

CorpComms magazine reports that the CIPR was offered a financial incentive (I'm told £500,000) to leave its former pad before its lease expired, because the landlord planned to turn the Georgian premises into a private home.

What the mag doesn't mention is that the landlord in question is my old friend, Greek property tycoon Achilleas Kallakis, who is currently at the centre of a Serious Fraud Office probe and (under the name Stefan Michalis Kollakis) was convicted of conspiracy to commit forgery 14 years ago.

His offer of payment to the CIPR was apparently only a gentleman's agreement with the trade body's director general, Colin Farrington - and the new owners of the property aren't that keen to honour the "deal" without supporting evidence. Worse, they are also looking to sting the CIPR for breaking its lease early.

None of which now seems to be Farrington's problem, though. He's currently on an "extended leave of absence".

CorpComms magazine reports that the CIPR was offered a financial incentive (I'm told £500,000) to leave its former pad before its lease expired, because the landlord planned to turn the Georgian premises into a private home.

What the mag doesn't mention is that the landlord in question is my old friend, Greek property tycoon Achilleas Kallakis, who is currently at the centre of a Serious Fraud Office probe and (under the name Stefan Michalis Kollakis) was convicted of conspiracy to commit forgery 14 years ago.

His offer of payment to the CIPR was apparently only a gentleman's agreement with the trade body's director general, Colin Farrington - and the new owners of the property aren't that keen to honour the "deal" without supporting evidence. Worse, they are also looking to sting the CIPR for breaking its lease early.

None of which now seems to be Farrington's problem, though. He's currently on an "extended leave of absence".

Wednesday, 4 November 2009

Over the Hills?

I hear that the William Hill boys are out schmoozing the bond markets this week in an attempt to raise some cash for the embattled bookie. Apparently the presentation has been poorly received. Developing...

Update: the offer is for £200 - 250 million senior notes to pay down bank debt and "general corporate purposes". Presumably they've already spent the £350m rights issue cash from April, then.

Update: the offer is for £200 - 250 million senior notes to pay down bank debt and "general corporate purposes". Presumably they've already spent the £350m rights issue cash from April, then.

Labels:

bond market,

William Hill

Tuesday, 3 November 2009

Relocation, relocation, relocation...

Does spread betting giant, IG Group, suddenly feel confident enough to become proper part of the City?

I hear that the FTSE 250 company has just signed a deal on new office space in the heart of the Square Mile - just behind Cannon Street station.

The relocation comes after years slumming it at its Blackfriars Road office - an unimpressive building that was (even worse) located south of the river.

I hear that the FTSE 250 company has just signed a deal on new office space in the heart of the Square Mile - just behind Cannon Street station.

The relocation comes after years slumming it at its Blackfriars Road office - an unimpressive building that was (even worse) located south of the river.

Labels:

city,

FTSE 250,

IG Group,

IG Index,

spread betting

Monday, 2 November 2009

Who's the Fuld?

The closing down sale of the Lehman Brothers art collection is providing plenty of opportunity to paint former boss Dick Fuld as a great art lover. But is he really such a polymath?

In the mid-1980s, when City firm L Messel was being acquired by the fast expanding investment bank, the young(er) Fuld was parachuted into London and put in charge of the European expansion.

Execs at Messel advised their new ambitious boss that if he was serious about achieving his aggressive plans, then they really needed to open a Frankfurt office.

"No way," he fired back earnestly. "We're never going behind the Iron Curtain!"

In the mid-1980s, when City firm L Messel was being acquired by the fast expanding investment bank, the young(er) Fuld was parachuted into London and put in charge of the European expansion.

Execs at Messel advised their new ambitious boss that if he was serious about achieving his aggressive plans, then they really needed to open a Frankfurt office.

"No way," he fired back earnestly. "We're never going behind the Iron Curtain!"

Labels:

art collection,

Dick Fuld,

Frankfurt,

Iron Curtain,

L Messel,

Lehman Brothers

Subscribe to:

Comments (Atom)